Vindow shares a wonderful article on 3 Essential Strategies for Your Business Recovery Plan.

Check out there website here: vindow.com

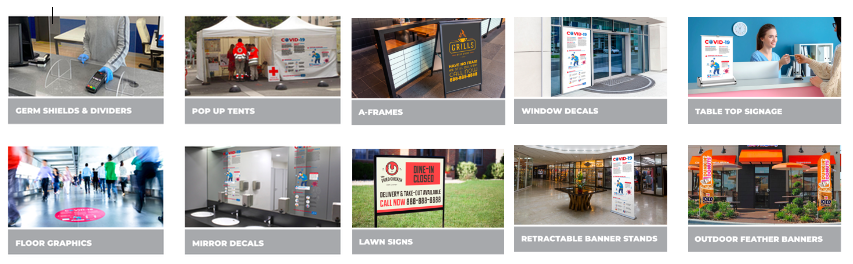

AAA Flag & Banner is here to help you open safely. Products to help keep your staff and customers safe.

Please contact sales@aaaflag.com or visit their website http://www.aaaflag.com/

GMBHA Members COVID-19 eNewsletter Archives:

________________________________

To be featured in our monthly eNewsletter, please reach out to Monica Walker, Membership Sales & Relations Manager at Monica@gmbha.com

GMBHA Allied Upgrade eNewsletter Archives:

Webinars:

Miami Herald Media Company Connects Families and Businesses with the Support They Need

While the Miami Herald and el Nuevo Herald work around the clock to provide trusted local news coverage of the COVID-19 pandemic, the Miami Herald Media Company has launched three initiatives to assist individuals, families and small businesses. The free

Shorecrest Construction always has been committed to safety with exceptional craftsmanship to help keep your employees and guests safe.

Emergency Services include:

- Partical To Full Renovations

- Repairs For Electrical, Plumbing, Floods, Etc

- Water Damage Assessment and Mitigation

- Building Interior and Exterior Repairs

- Repainting Areas of Damage

- Deep Cleaning and Sanitizing Area

- Furniture Removal and New Furniture Specification

For more information please contact Sarah Holland at collab@shorecrestgc.com or 786-282-6710

- Valet Screeners

- Greeter Screeners.

- Sanitizing Services/Light Maintenance Ambassadors.

- Internal Patient Transport (IPT).

- Patient Sitting Ambassadors (PSAs).

Click here to view the full document on Proven Healthcare Resources & Expert Solutions to Support Your Evolving Needs.

On April 23, 2020, the Equal Employment Opportunity Commission (“EEOC”) updated its Technical Assistance Q&A Guidance relating to COVID-19 and the Americans with Disabilities Act ("ADA") to clarify that employers are permitted to administer mandatory COVID-19 tests on employees before allowing them to enter the workplace without violating the ADA’s prohibition against medical examinations. This update can be found at question A.6. of the guidance. In doing so, the EEOC reasoned that such testing meets the ADA’s requirement that mandatory employee medical examinations be “job related and consistent with business necessity,” because an employee entering the workplace with COVID-19 “will pose a direct threat to the health of others” within the work environment.

If you or one of your clients has any questions regarding the new EEOC guidance outlined above, please reach out to a member of the Labor & Employment practice group for assistance. https://shutts.com/